Explaining Liquid Staking on Solana with Saifu

Posted on Wed Apr 20, 2022

Today, let’s talk a bit about staking and liquid staking - what it is, what the benefits and risks are, and how you can do it right from within Saifu!

Sounds good? Let’s go!

What is staking?

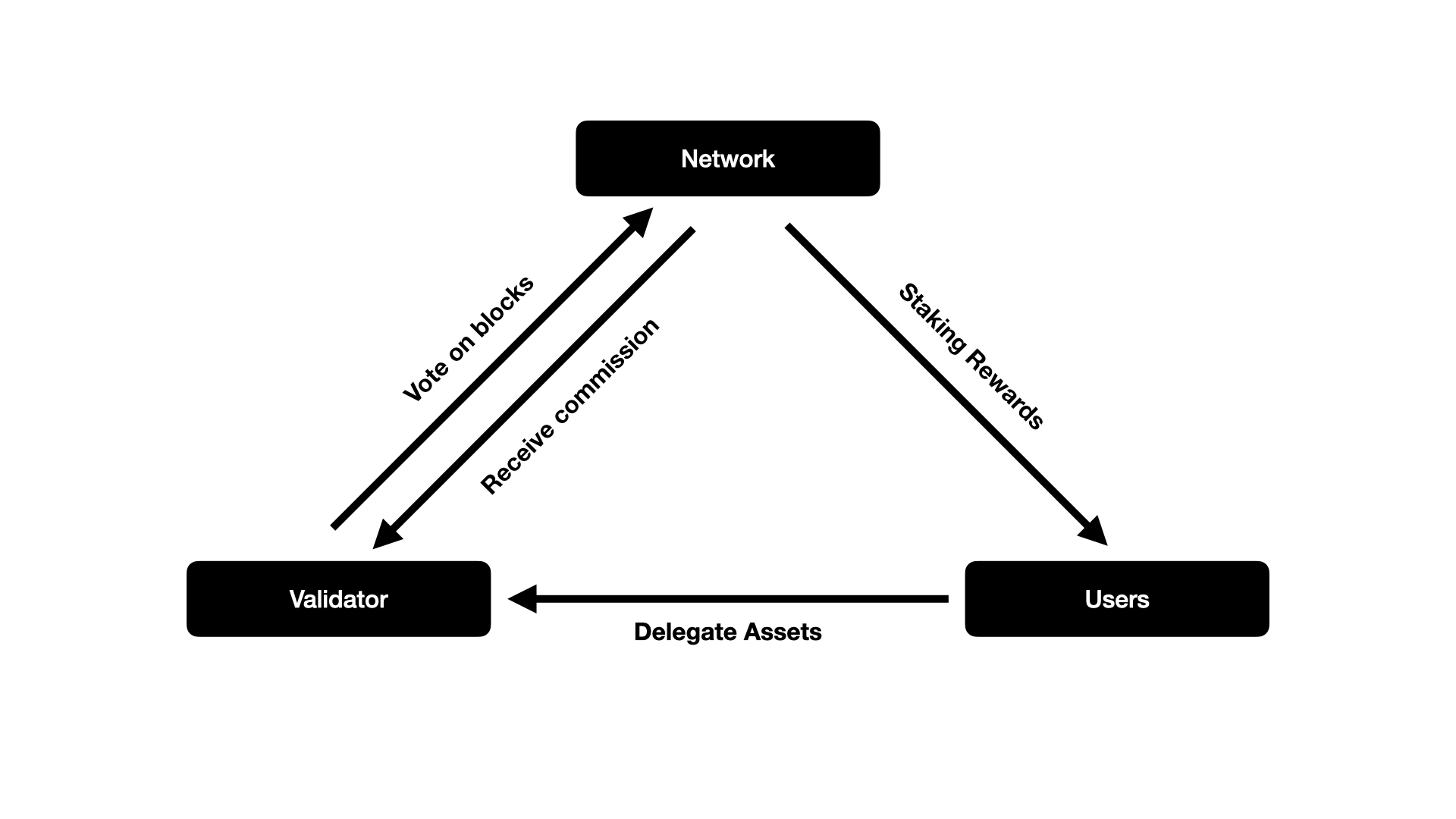

Solana and other so-called Proof of Stake chains operate with a network of validators. A validator is a computer or server that runs a specific program that validates and votes on upcoming blocks. This process (also known as consensus) is crucial for the security and integrity of the network.

As part of proof-of-stake, Validators vote on blocks they believe should be added to the blockchain next, essentially confirming transactions included in those blocks. Once per epoch (around two days), all Validators and Delegators in the first block of the following epoch will receive rewards for supporting the network, this is what we call Staking Rewards.

Not all validators have equal voting power - the weight of each Validators vote depends on how much stake has been delegated to it relative to the total amount staked on the entire network. This is where we, people that have SOL, come in.

Delegating SOL to Validators

What we call staking is more about delegating. We can delegate our SOL to a validator to give our voting power. The more SOL a Validator has, the heavier its vote becomes, and the more trustworthy it can be considered, effectively acting as a mechanism for integrity against malicious actors.

SOL delegated to Validators is bounded, which means to unstake it, we have to unbound it first, which usually takes up to 3 days and makes the SOL inaccessible until it completes.

Staking isn’t entirely risk-free. If a validator decides to act maliciously and votes on falsely crafted blocks, the validator can get punished through a process called slashing. Slashing destroys a big portion of the SOL delegated to it, including ours. This protects the network against bad actors, but also directly influences the reputation of Validators.

Then what is Liquid Staking?

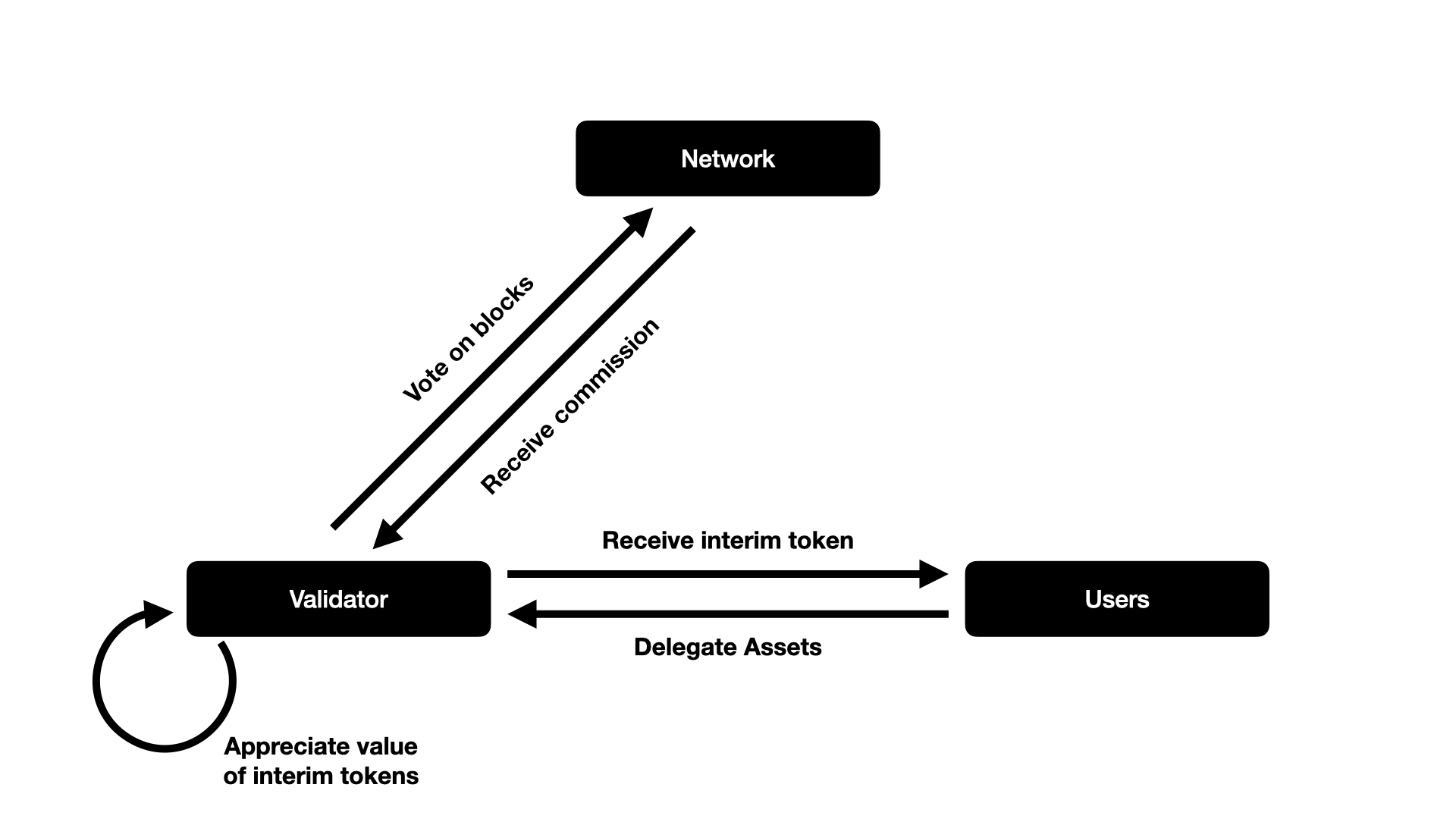

While staking happens at the core of the network, it also means that while we stake, our SOL is inaccessible to us - we’re effectively illiquid.

Liquid Staking tries to solve this by not leaving users fully without funds. The process is the same, a liquid staking provider uses users SOL to delegate to their validator to increase it’s voting power, but instead of leaving the user without funds, it returns an interim asset that acts as a digital “IOU” (such as stSOL or mSOL).

The asset (stSOL, mSOL, etc.) has a fixed value for which it can be redeemed back to SOL. But since we, the users, don’t get staking rewards directly from the network (because we’re effectively not officially part of the delegation process), Liquid Staking solves this by slowly appreciating the worth of their interim token.

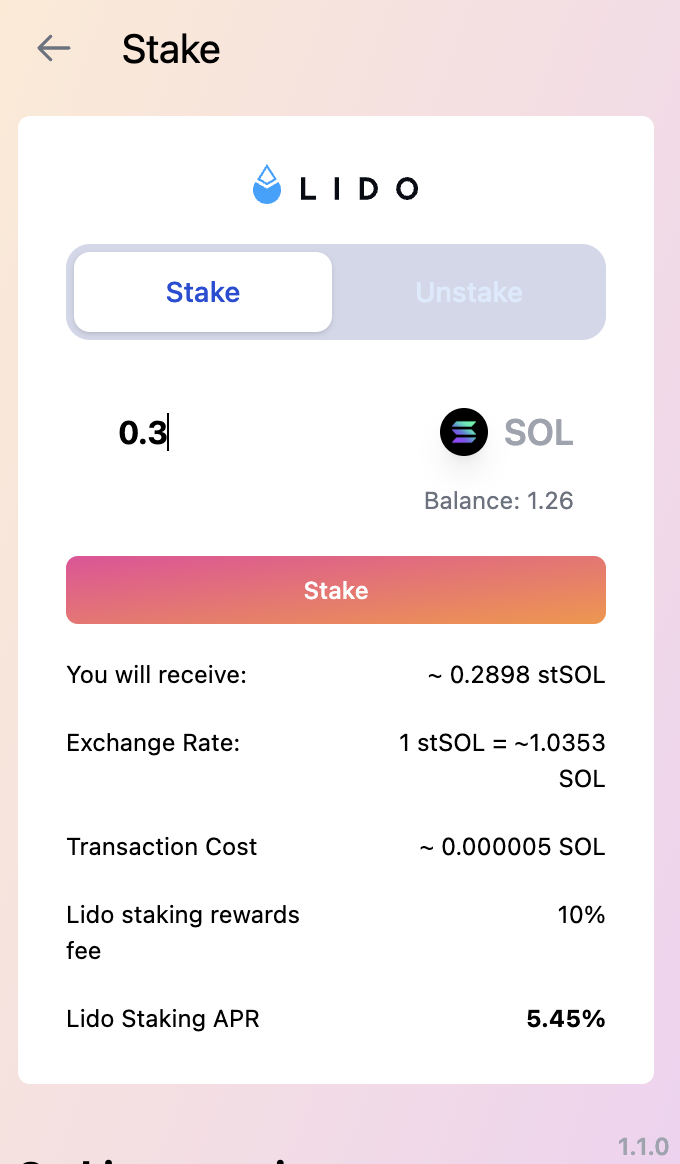

For example (as of writing), the exchange rate for one stSOL back to SOL is 1.0352, meaning one stSOL will get you 1.0352 SOL back. But because this asset appreciates over time due to the validator receiving staking rewards from the chain, the exchange rate for turning stSOL back into SOL will also slowly increase.

But what’s the point of this all?

The main point is that these interim assets (stSOL, mSOL) hold value. Because of their peg back to SOL, they can be used for all kinds of things that act on assets, most popular examples being lending and yield farming.

We know how much SOL goes into one stSOL, allowing us to use stSOL as collateral for taking out loans. If we get liquidated on our loan, the loan provider could take the liquidated stSOL and swap them back to SOL.

But we can also do the opposite - we can supply stSOL for lending. On providers like Solend, we can receive an extra 2.98% APY for supplying stSOL, increasing our return to 8.45% (5.47% from staking, 2.98% from supplying to Solend).

Getting started with Liquid-staking

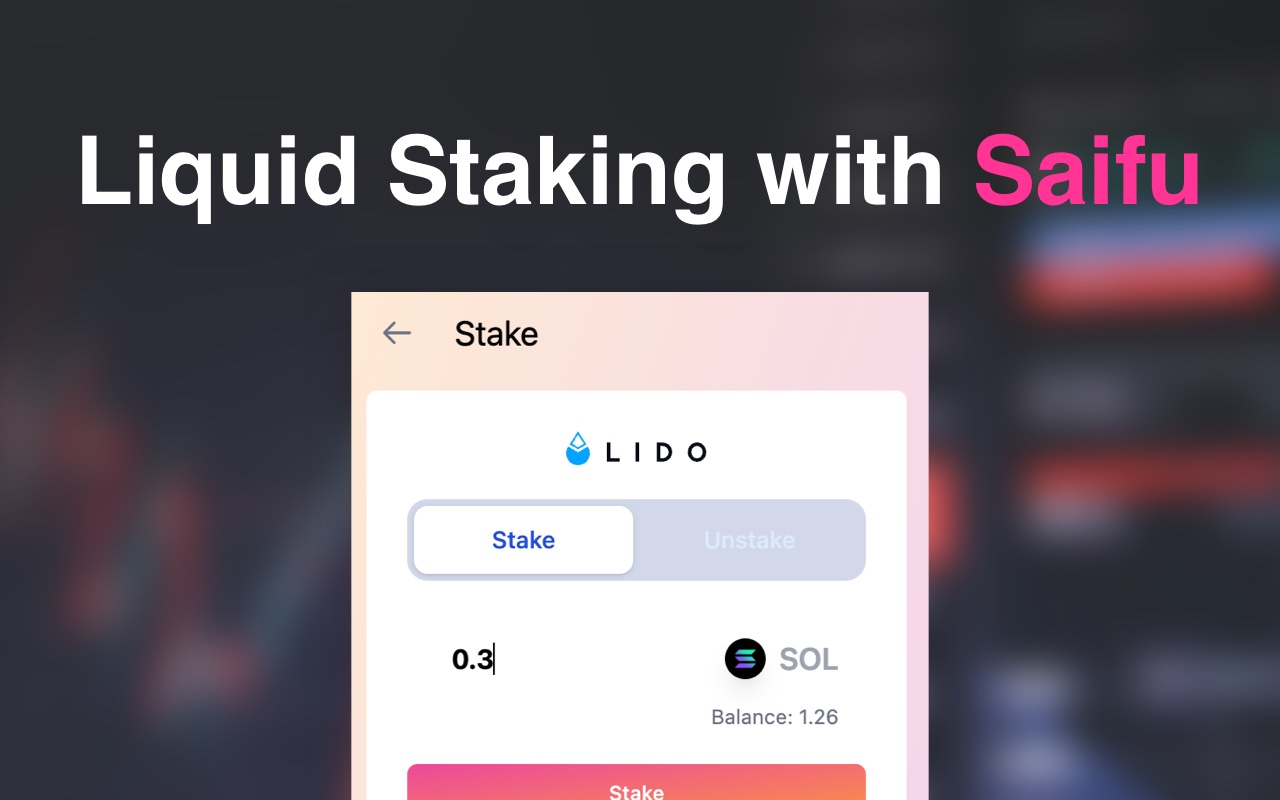

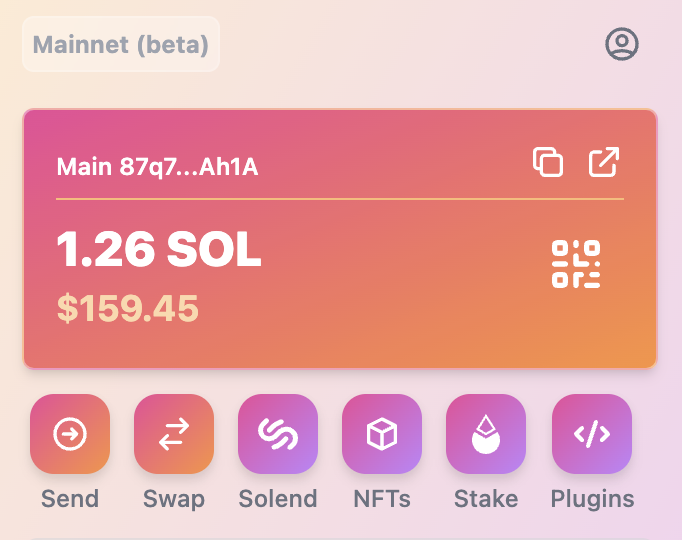

Saifu was built with advanced use-cases in mind and supports Liquid Staking (powered by Lido) right from the get-go.

After opening Saifu, hit the “Stake” button.

The “Stake” screen allows conversion from SOL to stSOL. The “Unstake” screen allows conversion from stSOL back to SOL.

Enter the amount you want to stake and hit the Stake button. After network confirmation, you’ll see stSOL tokens in your wallet. Great! You just delegated your SOL through Lido to their validator!

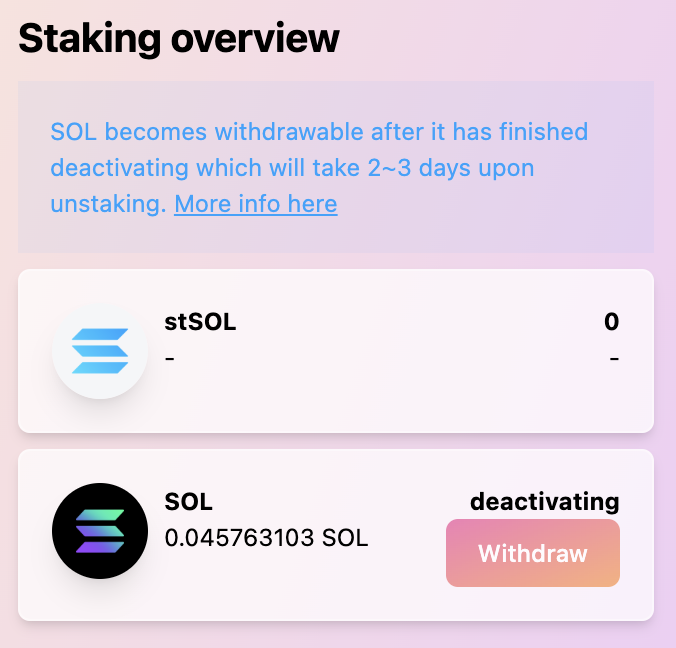

When you unstake you’ll notice that you don’t immediately get your SOL back. This is due to the unbounding period that also Liquid Staking providers have. Instead, you’ll see a new card showing up that tells you that you have a balance awaiting deactivation.

Once deactivation is complete, hit the “Withdraw” button to get your SOL back. Awesome!

Hint: You can also swap stSOL back into SOL through protocols like Jupiter, but the rate is slightly worse than going through the Unstake process. Just something to keep in mind if you urgently need the funds.

Tell us what you think

We hope this article got you up to speed with Liquid Staking. If you have questions or suggestions, shoot them over to our Twitter at @SaifuWallet or join our Discord.

Your feedback matters for evolving Saifu into the perfect wallet!

About Saifu Wallet

Saifu is the extensible Solana wallet - a wallet made for power users and advanced use-cases. Saifu supports an open plugin system to extend it with additional functionality, and Lido staking itself is one of those plugins.

Download Saifu at https://saifuwallet.com/ and get more out of your crypto!

Saifu Wallet

Saifu Wallet